child tax credit october payments

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. The Child Tax Credit provides money to support American families.

Child Tax Credit Will There Be Another Check In April 2022 Marca

CBS Detroit -- The fourth Child Tax Credit payment from the Internal Revenue Service IRS goes out tomorrow.

. The actual time the check arrives depends. The ongoing advance monthly payments for the child tax credit are also scheduled to arrive Oct. We provide guidance at critical junctures in your personal and professional life.

Even though child tax credit payments are scheduled to arrive on certain dates you may not. Parents received Octobers check last week via direct deposit with checks coming in the mail. With TurboTax Its Fast And Easy To Get Your Taxes Done Right.

Ad Let Us Walk You Through The Latest Tax Law Changes As You File. Learn More At AARP. The 2021 advance monthly child tax credit payments started automatically in July.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6 to 17 for 2021. File a federal return to claim your child tax credit.

This means that the total payment will be spread over four months rather than six making each monthly payment larger the agency said. Last December the CBO estimated that making the 2021 credit under ARPA and the TCJA permanent would cost 1597 trillion between 2022 and 2031. IR-2021-201 October 15 2021.

For qualifying children claimed. For example the maximum monthly payment for a family that received its first payment in October is 500-per-child for kids ages 6 through 17 and 600-per-child for kids. File a federal return to claim your child tax credit.

October 14 2021 459 PM CBS Chicago. Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. For these families each payment is up.

Again you want to wait until you see the actual direct deposit or the check in. Thats an increase from the regular child tax. Here is some important information to understand about this years Child Tax Credit.

Heres the latest on missing checks and how to cancel future payments. Starting with the October payments the individuals who received those payments approximately 220 000 people will stop receiving payments. The Child Tax Credit reached 611 million children in.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Ad Tax Strategies that move you closer to your financial goals and objectives. The United States federal child tax credit CTC is a partially-refundable tax credit for parents with dependent childrenIt provides 2000 in tax relief per qualifying child with up to 1400 of that.

CBS Detroit --The Internal Revenue Service IRS sent out the fourth round advance Child Tax Credit payments on October 15. The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021. The JCT has made.

Simple or complex always free. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund. Simple or complex always free.

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Absence Of Monthly Child Tax Credit Leads To 3 7 Million More Children In Poverty In January 2022 Columbia University Center On Poverty And Social Policy

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Federal Reserve Banks Share Information About Advance Child Tax Credit Payments

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Missing A Child Tax Credit Payment Here S How To Track It Cnet

Missing A Child Tax Credit Payment Here S How To Track It Cnet

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

2021 Child Tax Credit Advanced Payment Option Tas

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

Monthly Child Tax Credit Payments Begin Today Here S How Much You Can Expect Nextadvisor With Time

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/70761715/1235261204.0.jpg)

Why Did Congress Let The Expanded Child Tax Credit Expire Vox

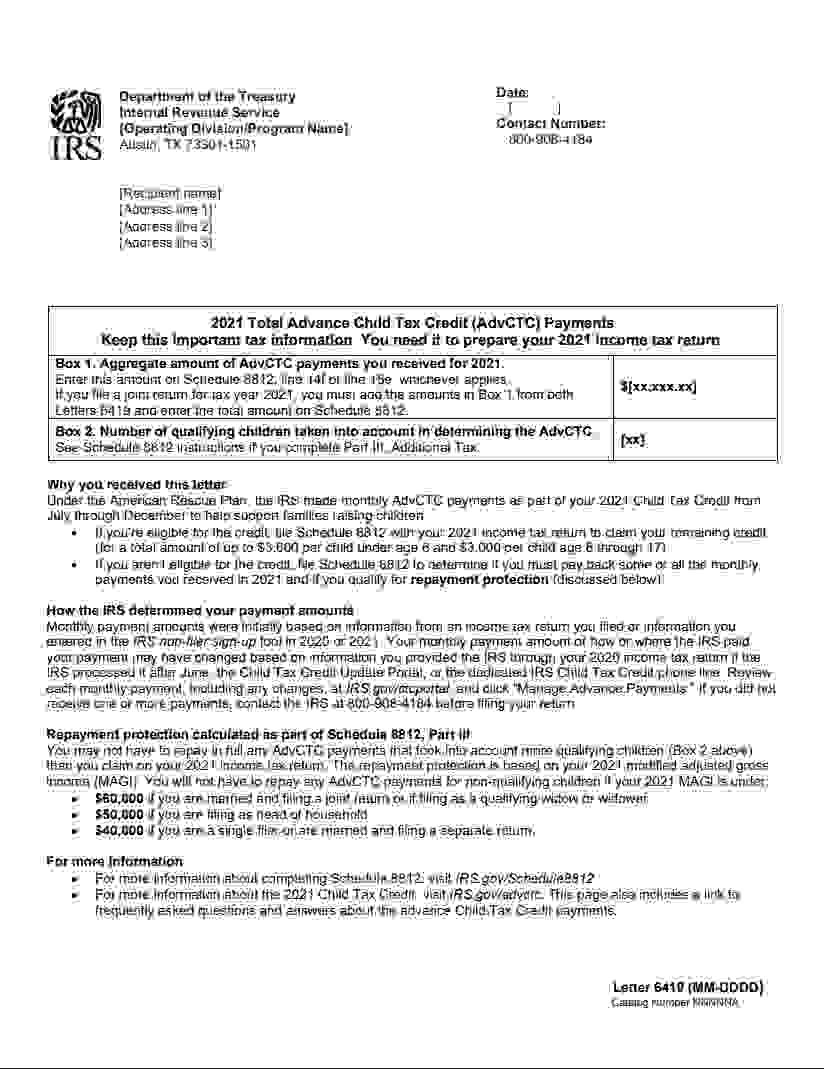

Child Tax Credit Update What Is Irs Letter 6419 Gobankingrates